The modernization level and scale of machine tool industry is one of the important signs of the industrial development of a country. The traditional manufacturing power of machine tool industry is mainly Germany, Japan, Italy and other industrialized developed countries. At the same time, with the improvement of the overall strength of the domestic industry, China has become a machine tool manufacturing power.

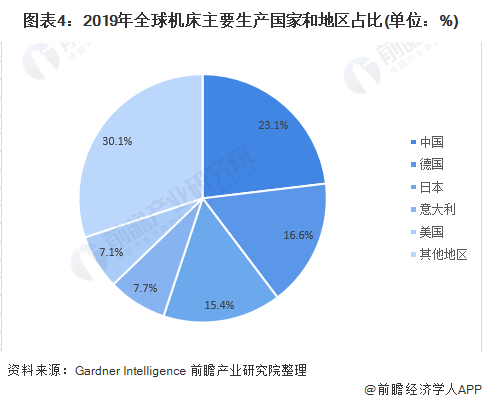

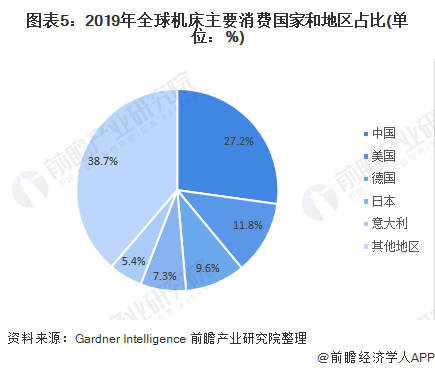

At present, in terms of supply, China’s machine tool industry ranks first in the world with an output value of 19.42 billion US dollars, accounting for 23.1% of the global market share. In terms of demand, Chinese consumption ranked first in the world, accounting for 27.2 percent of the global demand market with a total consumption of 22.3 billion U.S. dollars. Although China occupies an important market share in the global machine tool supply and demand market, it is a machine tool power, but it is not a machine tool power, and middle and high-end models still rely on imports.

Development history of global machine tool industry

Machine tool has experienced five stages of development from its appearance, namely embryonic period, generation period, precision period, semi-automatic period and automatic period.

Current situation of global machine tool industry supply and demand

Gardner Intelligence, a company specializing in the statistical analysis of the global machine tool industry for many years, recently released the world Machine Tool Industry Survey 2019, which includes metal cutting and metal forming machines.

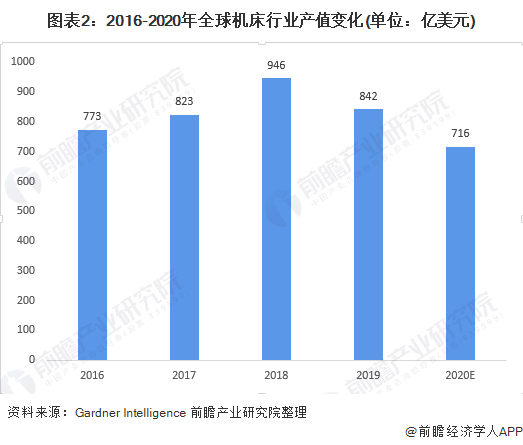

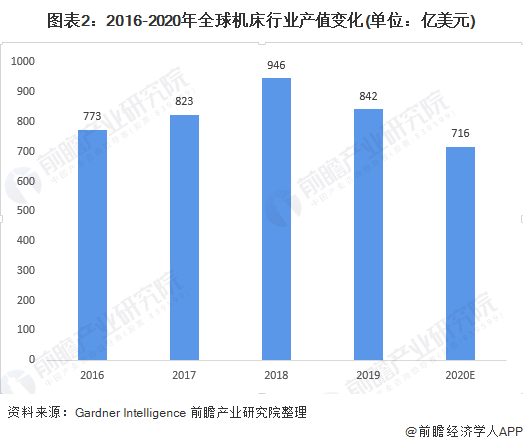

Data from the report shows that the output value of the global machine tool industry increased year by year from 2016 to 2018, and began to decline in 2019. Global machine tool output was $84.2 billion in 2019, down 11% from the previous year. In 2020, global machine tool production is likely to decline even more due to the spread of the global epidemic and a significant reduction in economic activity, with a forward-looking forecast of us $71.6 billion.

Data from the 2019 World Machine Tool Industry Statistical Survey report show that the global machine tool consumption and output value show a similar trend of change, that is, from 2016 to 2018, the trend was increasing year by year, and began to decline in 2019. In 2019, the global consumption of machine tools was us $82.1 billion, down 10.66% year-on-year. The global machine tool consumption and output value maintain a similar trend, based on the forward-looking forecast of 2020, the global machine tool consumption is 69.8 billion DOLLARS.

The output value of Machine tools in China ranks first in the world

In terms of machine tool supply market, in 2019, the global output value of machine tool industry was $84.2 billion, of which China ranked first in the world with an output value of $19.42 billion, accounting for 23.1% of the global market share. The output value of Germany and Japan was 14 billion US dollars and 12.99 billion US dollars respectively, ranking the second and third in the world respectively, with a share of 16.6% and 15.4% in the global market. Three countries, China, Germany and Japan, account for 55.1 percent of the global share.

China’s consumption of machine tools ranks first in the world

In terms of the machine tool demand market, in 2019, the global consumption of machine tool industry was 82.1 billion DOLLARS, among which China ranked the first in the world with consumption of 22.3 billion dollars, accounting for 27.2% of the global demand market. The CONSUMPTION of the US and Germany was 9.7 billion US dollars and 7.9 billion US dollars respectively, ranking second and third in the world respectively, and accounting for 11.8% and 9.6% of the global demand market respectively. China, the United States and Germany accounted for 48.6 percent of the global share.

The supply and demand of China’s machine tool industry ranks first in the world

(Source: Gardner Intelligence online)